Industry V Retail Super Funds

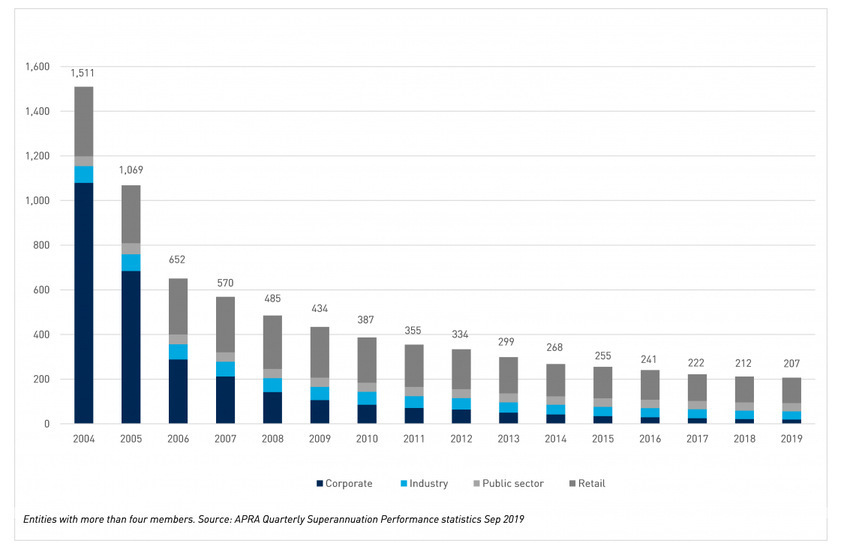

While past performance is not a reliable indicator of future performance the Productivity Commissions report into super found that not-for-profit funds outperformed retail funds on average. Retail super funds are typically owned by financial institutions such as investment companies or banks and are generally available for anyone to join.

Supermarket Carrefour Pls Back To School Supermarket Carrefour Back To School

Get up to speed on any industry with comprehensive intelligence that is easy to read.

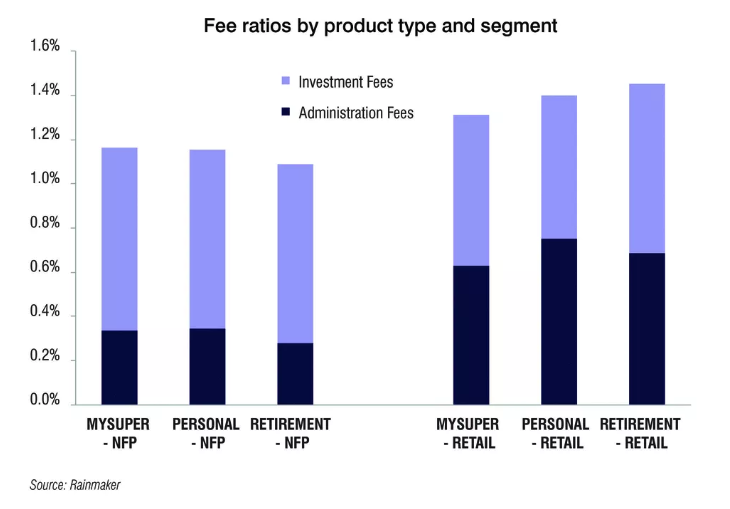

Industry v retail super funds. Broad comparisons of industry and retail super conceals a multitude of under-performing sub-scale union funds. Industry funds and public sector funds continue to do better than retail funds. Industry super funds have on average performed better than retail super funds over the long term according to research and advocacy group Industry Super Australia.

Rest is an award-winning profit-to-member super fund with low fees. Industry super funds are profit to member organisations which means profits are returned to members not shareholders. Broadly retail super funds can be classified as for-profit funds because the companies that own them are typically run for the profit of owners and shareholders.

But for most people an industry or retail super fund is more appropriate. Retail super funds have a responsibility to shareholders while. Between retail and industry super funds this again depends on the fund but generally speaking industry funds have the edge.

If a body corporate is a wholesale client then any related body corporate is also a wholesale client. Funds run by the employer or an industry fund are generally not-for-profit while those run by retail funds retain some profits. Find industry analysis statistics trends data and forecasts on Retail Superannuation Funds in Australia from IBISWorld.

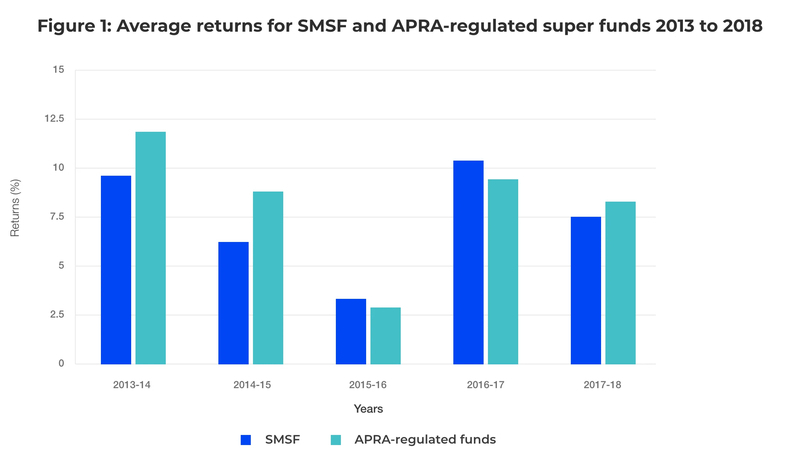

Industry vs retail super fund performance. In 2018 the Productivity Commission noted in a draft report that when comparing MySuper products basic super funds over 10 years 14 out of 16 retail funds underperformed their benchmarks compared to 7 of the 33 industry funds surveyed. Balanced Indexed was awarded Best Value Super Product 2021 recognising the.

Moira Geddes discusses the difference between industry and retail super funds with Industry Super Australia chief David Whiteley. Super funds by value of assets b December 2019 to December 2020. The main difference between industry super funds and retail super funds or wholesale master trusts which are public offer funds managed by financial institutions is what happens with the profits.

Vision Super is an industry super fund working for our members. Retail super funds are commonly run by financial institutions such as banks or wealth management companies and return profits to shareholders. For a second year Rests Balanced Indexed investment option has been named Money magazines Best of the Best.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test. Not having a profit motive means they are not profit driven but that doesnt mean that they are all. According to Moneysmart industry super funds also typically range from low to medium cost.

More than 5 million Australian workers belong to an industry super fund. Sometimes a super fund will be both an industry fund as well as a MySuper fund. The key difference between these funds and retail funds is that they are owned by members not shareholders.

Some large corporates operate the fund under a board of trustees representing the employer and employees. Smaller corporate funds may operate under the umbrella of a large retail or industry super fund. While retail and industry funds hold similar levels of listed equities industry funds held more infrastructure while retail funds held more cash and hedge funds.

Retail funds distribute profits to shareholders or investors the trustees of the fund while industry funds return profits to members. Banks consultants sales marketing teams accountants and students all find value in IBISWorld. The main difference between an industry super fund and a retail super fund is how their profits are managed.

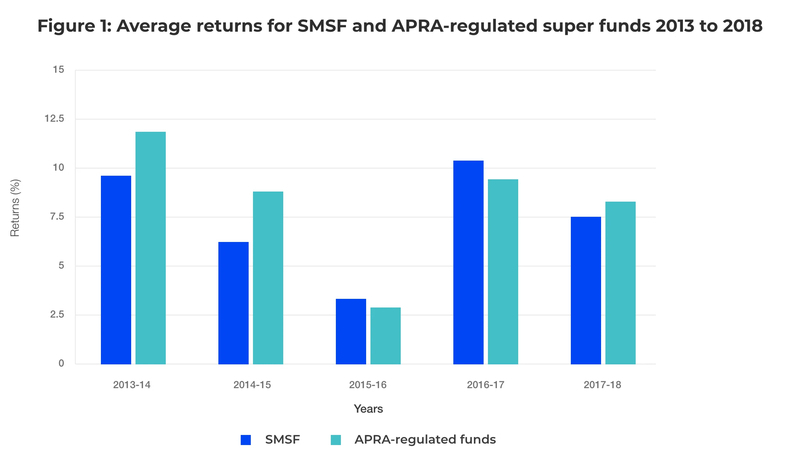

The reason for this is due to. Lower fees industry funds have almost 40 lower fees than the average retail fund. An SMSF can give you more control over your investments and tax outcomes and it can also provide access to some.

For superannuation products the client must generally except for some large superannuation funds always be treated as a retail client regardless of their eligibility to be a wholesale client. In 2016 the median return for industry super funds was 82 per cent while retail for-profit funds which are largely controlled by the big banks and AMP achieved 69 per cent.

The 10 Best Granville Island Tours Tickets 2021 Vancouver Viator Granville Island Vancouver Things To Do Island Tour

Australian Government Partners With Ibm To Create National Blockchain To Read More Latest News Visit Htt Blockchain Cryptocurrency News Blockchain Technology

How Smsfs Compare With Retail And Industry Super Funds Savings Com Au

How Big Is Apple Compared To The Largest Companies Of Each Country Visualized Digg Public Company Marketing Map

Resume Example With Headshot Photo Cover Letter 1 Page Word Resume Design Diy Cv Example Resume Objective Resume Objective Statement Resume Examples

How Smsfs Compare With Retail And Industry Super Funds Savings Com Au

Solar Energy Monitoring System For Home Powerguide Solar Energy Energy App Support

10 Businesses To Start Now To Be Rich In A Decade Starting A Business Best Business To Start How To Get Rich

How Smsfs Compare With Retail And Industry Super Funds Savings Com Au

Business Ecosystem In 2021 Powerpoint Powerpoint Slide Templates Ecosystems

Industry Super Funds Lead Retail Funds In Assets Satisfaction And Performance

Bar Graph Showing The Estimated Average Smsf Expense Ratio As A Percentage By Fund Size For Administrative And Operating Expenses In Bar Graphs Investing Fund

Overused Logo Sold On Www 99designs Com Logo Design Math Logo Logo Design Contest

Industry Super Vs Retail Super Funds Canstar

Posting Komentar untuk "Industry V Retail Super Funds"